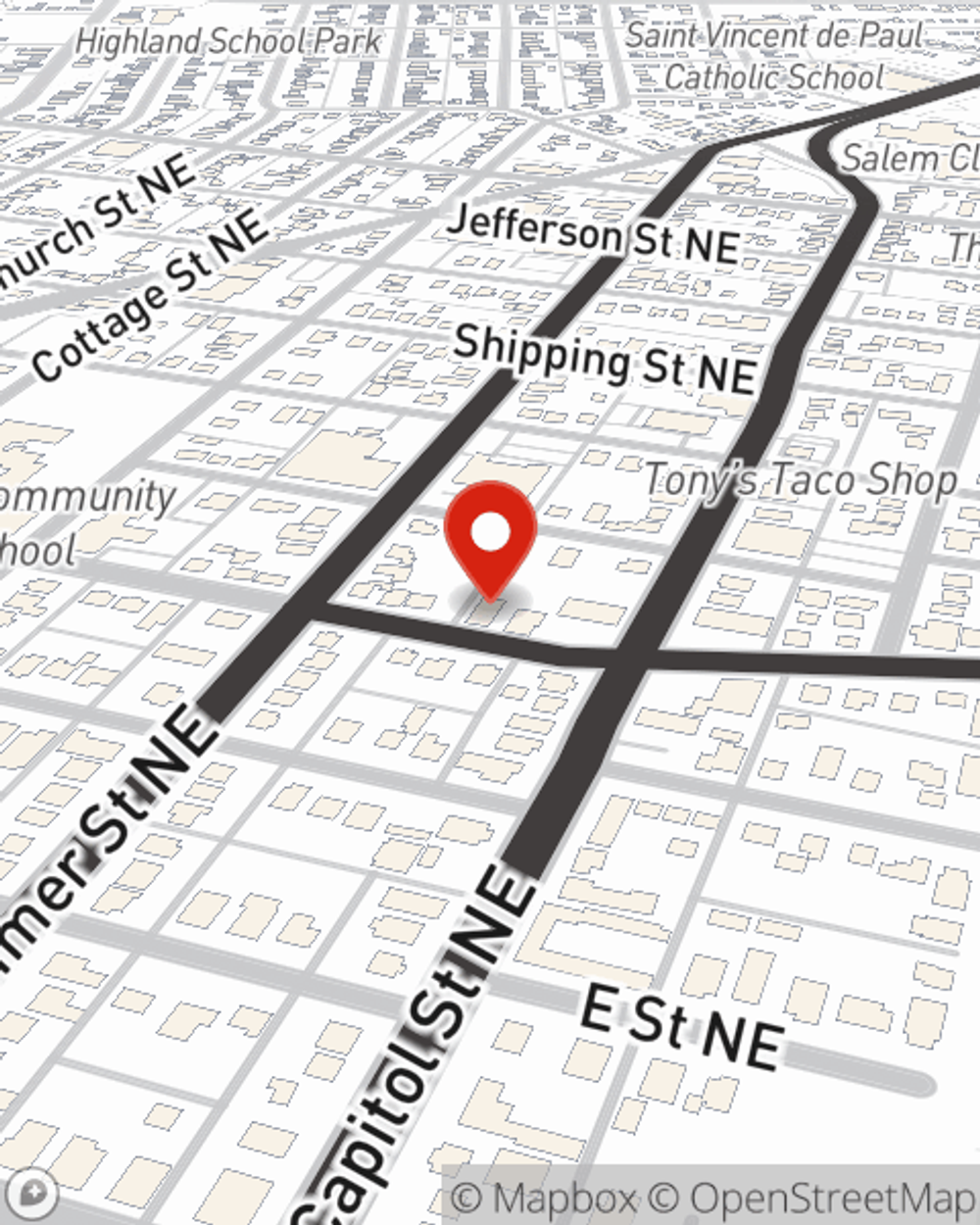

Business Insurance in and around Salem

One of Salem’s top choices for small business insurance.

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Preparation is key for when an accident happens on your business's property like a customer slipping and falling.

One of Salem’s top choices for small business insurance.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

Protecting your business from these potential problems is as easy as choosing State Farm. With this small business insurance, agent Cody Remington can not only help you design a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Don’t let worries about your business keep you up at night! Reach out to State Farm agent Cody Remington today, and learn more about how you can save with State Farm small business insurance.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Cody Remington

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.